Blog

National Minimum Wage Increases

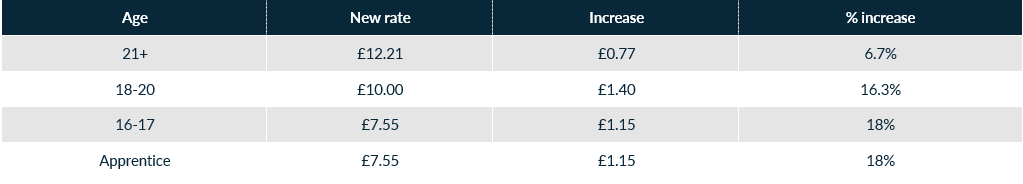

Following recommendations by the Low Pay Commission (LPC), the government has confirmed the new hourly rates for the National Minimum Wage/National Living Wage (NLW) from 1 April 2025.

For the first time, the government asked the LPC to take into account cost of living, including expected trends in inflation up to March 2026, when recommending the NLW. April will also see the introduction of the changes to employer National Insurance contributions, Statutory Sick Pay, and Family Friendly Rights.

As of 1 April 2025, new hourly rates for the National Minimum Wage/National Living Wage will apply as follows:

| Age | New Rate | Increase | % increase |

|---|---|---|---|

| 21+ | £12.21 | £0.77 | 6.7% |

| 18-20 | £10.00 | £1.40 | 16.3% |

| 16-17 | £7.55 | £1.15 | 18% |

| Apprentice | £7.55 | £1.15 | 18% |

Employers will need to ensure that they are paying their hourly-paid employees at the appropriate rates and also checking that any salaried employees are still earning above the National Minimum Wage. Based on the new figures, someone working a full-time 35 hour per week contract should be earning £22,222.20 per annum (£427.35 per week).

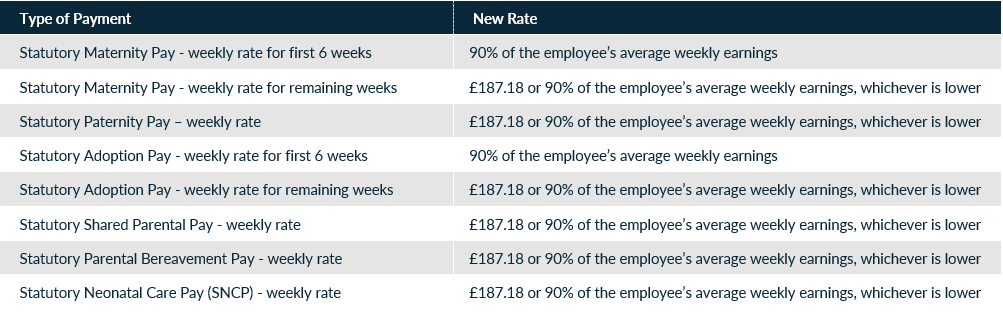

Family Friendly Rights will also increase from 6 April 2025 as follows:

| Type of Payment | New Rate |

|---|---|

| Statutory Maternity Pay – weekly rate for first 6 weeks | 90% of the employee’s average weekly earnings |

| Statutory Maternity Pay – weekly rate for remaining weeks | £187.18 or 90% of the employee’s average weekly earnings, whichever is lowest |

| Statutory Paternity Pay – weekly rate | £187.18 or 90% of the employee’s average weekly earnings, whichever is lowest |

| Statutory Adoption Pay – weekly rate for first 6 weeks | 90% of the employee’s average weekly earnings |

| Statutory Adoption Pay – weekly rate for remaining weeks | £187.18 or 90% of the employee’s average weekly earnings, whichever is lowest |

| Statutory Shared Parental Pay – weekly rate | £187.18 or 90% of the employee’s average weekly earnings, whichever is lowest |

| Statutory Parental Berevament Pay – weekly rate | £187.18 or 90% of the employee’s average weekly earnings, whichever is lowest |

| Statutory Neonatal Care Pay (SNCP) – weekly rate | £187.18 or 90% of the employee’s average weekly earnings, whichever is lowest |

Statutory Sick Pay will increase to £118.75 per week from 6 April 2025.

Finally, as of 6 April 2025, there will also be increases to employer National Insurance contributions.

Our Employment Team is here to help you navigate these changes, from updating contracts to ensuring your payroll aligns with the new rates. Don’t wait—reach out today using the form below to safeguard your business and avoid potential penalties.